How To Find Beginning Capital Balance

Owners Capital Definition

Owners Capital is likewise referred to equally Shareholders Equity. It is the coin business organisation owners (if it is a sole proprietorship or partnership) or shareholders (if it is a corporation) have invested in their businesses. In other words, it represents the portion of the total assets which accept been funded past the owners/ shareholders money.

Owners Capital Formula

It tin can be calculated as follows:

Owners Capital letter Formula = Total Assets – Total Liabilities

Y'all are free to use this paradigm on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Owners Uppercase (wallstreetmojo.com)

For example, XYZ Inc. has total assets Total Assets is the sum of a company'south current and noncurrent assets. Total assets too equals to the sum of total liabilities and full shareholder funds. Full Assets = Liabilities + Shareholder Equity read more of $50m and full liabilities of $30m every bit at 31st December 2018. Then Owners Majuscule is $20m (Assets of $50m fewer Liabilities of $30m) as at 31st December 2018. It tin be interpreted from to a higher place that assets of $20m are funded by the Owners/ Shareholders of the concern. Remaining $30m have been funded through externally sourced funds (i.eastward., loans from banks, issuance of bonds, etc.)

Components of Owners Uppercase

#1 – Common Stock

Common Stock is the amount of capital contributed by the common shareholders of the company. It is shown at the par value in the Residuum Sheet.

#2 – Additional Paid-In Capital

Additional Paid-In Capital Additional paid-in upper-case letter or capital surplus is the company'south excess amount received over and above the par value of shares from the investors during an IPO. It is the profit a company gets when it problems the stock for the first fourth dimension in the open market. read more refers to the amount over and above the stated par value of the stock that has been paid past the shareholders to learn the company shares.

Boosted Paid-In Capital = (Issue Price- Par Value) x Number of Shares Issued.

Let's presume that as of 31st December 2018, XYZ Company issued the total number of mutual shares of 10,000,000 having a par value of $ane per share. Further, assume that mutual shareholders paid $10 each to acquire all the shares of the visitor. In this case, boosted paid-in majuscule would be reported at $90m (($10-$i) 10 10,000,000)) under shareholders disinterestedness in the Remainder Sheet.

#3 – Retained Earnings

Retained Earnings Retained Earnings are divers as the cumulative earnings earned past the company till the appointment after adjusting for the distribution of the dividend or the other distributions to the investors of the company. It is shown as the part of owner's equity in the liability side of the remainder sheet of the visitor. read more is the portion of net income available for common shareholders that have not been distributed as dividends. These are retained by the company for future investments and growth. Considering that the amount retained by the visitor belongs to its mutual shareholders, this is shown under shareholders' equity Shareholder's disinterestedness is the residual interest of the shareholders in the company and is calculated as the difference between Assets and Liabilities. The Shareholders' Equity Statement on the rest canvass details the change in the value of shareholder's equity from the beginning to the terminate of an accounting flow. read more in the residuum sheet. It increases when the company makes profits and decreases when a visitor makes losses.

For case, if the company earned net income (after paying preferred dividends Preferred dividends refer to the amount of dividends payable on preferred stock from profits earned by the company, and preferred stockholders accept priority in receiving such dividends over common stockholders. read more than ) of $5m for the financial year catastrophe 2018 and distributed $2m as dividends to its common shareholders. This means that the visitor's management has decided to retain $3m in the company for its future growth and investments.

#4 – Accumulated Other Comprehensive Income/ (loss)

These are some income/expenses that are not reflected under the income statement The income statement is 1 of the company'due south financial reports that summarizes all of the company's revenues and expenses over fourth dimension in guild to determine the company's profit or loss and measure its business action over fourth dimension based on user requirements. read more . It is so because they are not earned incurred by the company but affect Shareholder'south equity Business relationship during the menses.

Hither are some examples of items. Other Comprehensive Income Other comprehensive income refers to income, expenses, revenue, or loss not beingness realized while preparing the visitor'due south fiscal statements during an accounting flow. Thus, information technology is excluded and shown after the cyberspace income. read more includes unrealized gains or losses Unrealized Gains or Losses refer to the increase or decrease respectively in the paper value of the company'south different assets, even when these assets are non yet sold. In one case the assets are sold, the company realizes the gains or losses resulting from such disposal. read more on available for sale securities, actuarial gains or losses on defined benefit plans A Defined Do good Plan (DBP) is an employer-funded alimony scheme set upward to pay a pre-established amount on retirement to employees. Under this organisation, a company takes full responsibility for planning its employees' retirement fund. This programme offers the twin advantage of greater tax deductions to the sponsor company and a guaranteed retirement income to its employees. read more than , foreign currency adjustments.

#5 – Treasury Stock

Treasury stock Treasury Stock is a stock repurchased by the issuance Company from its current shareholders that remains non-retired. Moreover, information technology is not considered while calculating the Visitor'due south Earnings Per Share or dividends. read more is the stock that has been reacquired past the company from the shareholders and thus reduces the shareholder's disinterestedness. It is shown every bit a negative number in the Residual Canvass. In that location tin can be two methods for accounting treasury stock, i.eastward., Price and Par Value Method.

Examples of Owner's Capital Adding

Below are the examples.

Example #1

Say ABC Ltd. has total avails of $100,000 and full liabilities of $xl,000. Summate the Possessor's Capital.

Calculation of the Possessor's Capital

- =$100000-$40000

- =$60000

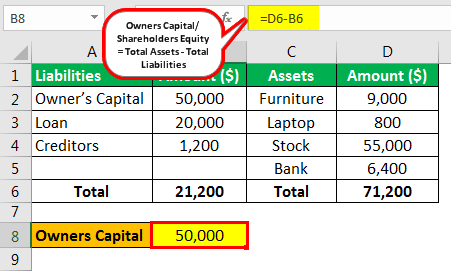

Example #2

Allow's see a practical application. Tom runs a grocery shop. He started information technology on anest January'2019 with his savings of $40,000 and a loan that he took from his uncle for $20,000. He purchased a laptop for $1,000; furniture for $10,000; stock for $45,000 and balance $4,000 was kept in banking concern for 24-hour interval to day expenses. At the cease of the year, i.e., 21st Dec'2019, his balance sheet stood at follows:

| Liabilities | Amount ($) | Avails | Amount ($) |

|---|---|---|---|

| Owner's Capital letter | l,000 | Article of furniture | 9,000 |

| Loan | 20,000 | Laptop | 800 |

| Creditors | i,200 | Stock | 55,000 |

| Depository financial institution | 6,400 | ||

| Total | 71,200 | Total | 71,200 |

How these figures actually got changed? Let's understand; Tom must accept sold his stock at prices college than the buy price. He must have incurred some expenses like electricity, insurance, accounts, finance charges The finance accuse, also known every bit the cost of borrowing or cost of credit, is the accrued interest or fees that accept been charged on the approved credit facility. Usually, this charge is a flat fee, merely almost of the fourth dimension it is a percentage of the corporeality borrowed on an extended line of credit. read more , etc.. Also, he might accept fabricated some connections, then he was able to purchase some stock on credit. All these events led to cash inflow as well as greenbacks outflow. The profit he actually made afterwards all these are at present added to the Owner's Capital letter.

Now if we calculate Owner'southward Capital by using Avails – Liabilities formula and then nosotros go:

- =$71200 – $21200

- =$50000

Alter in Owner's Capital letter

- #1 – Profit/Loss: The owner's upper-case letter changes every year due to profit or loss arises in business. Profit increases the owner's uppercase while losing decreases it.

- #2 – Buyback: Buyback means repurchase of capital that was once issued by the company due to diverse reasons such as idle cash, boosting financial ratios Financial ratios are indications of a visitor'due south fiscal performance. There are several forms of financial ratios that point the company's results, financial risks, and operational efficiency, such equally the liquidity ratio, nugget turnover ratio, operating profitability ratios, business risk ratios, financial hazard ratio, stability ratios, and and so on. read more than , etc. It results in a decrease in the owner'due south capital.

- #iii – Contribution: The owner's capital increases when contributions are made past existing owners or past new owners. When new owners come into the business organisation, then they contribute as per the buying they will be acquiring.

Advantages and Disadvantages of Owner's Capital

Given below are some of the advantages and disadvantages of the owner's uppercase.

Advantages of the Possessor's Capital

- #1 – No burden of Repayment: Unlike debt capital letter, at that place is no burden of repayment in the instance of the owner's capital. It is thereby considered a permanent source of funds. This helps management to focus on its core objectives and flourish the business.

- #2 – No Interference: When a business organization has Debt every bit a major source of funds, the chances of interference by lenders are high. This can become a hindrance to the growth of a business organization. While in the case of the owner's capital, management has sole discretion in deciding whatever is proficient for the business.

- #3 – No Impact of Interest Charge per unit: If a company is highly dependent on variable rate debt majuscule, then an increase in interest rate can significantly affect its greenbacks flows Cash Menstruum is the corporeality of greenbacks or cash equivalent generated & consumed by a Company over a given period. It proves to exist a prerequisite for analyzing the business's strength, profitability, & telescopic for betterment. read more , while in the case of the owner's uppercase, there is no bear upon of changes in interest rate.

- #4 – Easy Accessibility to Debt Capital letter When the company has plenty owner's capital letter, then it is ever piece of cake to get additional debt capital as information technology shows that the company is strong and working independently.

Disadvantages

- #1 – College Price: Cost of owner'due south capital is the render which such upper-case letter could have earned in whatsoever other investment opportunity. Since business e'er posses adventure, so expected render from such capital is higher than the debt capital. Debt Majuscule is usually secured by a tangible asset Any concrete avails owned by a business firm that tin can be quantified with reasonable ease and are used to carry out its business activities are defined every bit tangible avails. For case, a company's land, besides as any structures erected on it, furniture, machinery, and equipment. read more than .

- #two – No Leverage Benefit: Involvement expense comes with a benefit of tax shield, which means a visitor tin can claim it as a business expense Business concern expenses are those incurred in society to successfully run, operate, and maintain a concern. Travel & conveyance, salaries, rent, amusement, telephone and internet expenses are all examples of business expenses. read more . Like any other expense, it reduces the taxable profit. Withal, this tax saving is foregone in case of owner'southward capital as dividend Dividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company'south equity. read more doesn't business relationship as a business expense.

- #3 – Dilution: Raising the new owner's upper-case letter dilutes the holding of existing owners. However, this doesn't happen in the case of debt capital. Business organisation can grow with the use of debt capital, and at the same time, the valuation of such a business doesn't get diluted.

Conclusion

Owners Capital is a vital part of any concern. It is the base upon which the whole company stands and grows. Concern tin can exist carried out with only the possessor's capital or with debt or a mix of disinterestedness and debt. An optimal mix of shareholders' disinterestedness and debt is considered equally the best option to get leverage benefits. Notwithstanding, the owner's capital letter is highly appreciated when the cost of debt is higher than the return business is providing.

Having a balanced owner's capital shows that the company is secured and does not merely rely on outsiders for carrying its business organisation.

Recommended Articles

This article has been a guide to Owners Uppercase and its definition. Hither we talk over the formula to summate the owner's majuscule along with its components, examples, advantages, and disadvantages. You lot can learn more than almost finance from following manufactures –

- Bank Capital

- Capital Loss Example

- Negative Shareholders Equity Examples

Source: https://www.wallstreetmojo.com/owners-capital/

Posted by: sheppardforgiagether.blogspot.com

0 Response to "How To Find Beginning Capital Balance"

Post a Comment